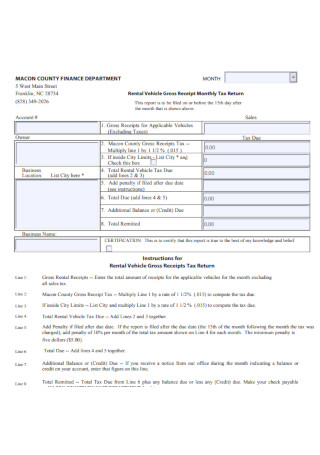

- MONTHLY GROSS RECEIPTS EXAMPLE CODE

- MONTHLY GROSS RECEIPTS EXAMPLE LICENSE

- MONTHLY GROSS RECEIPTS EXAMPLE PROFESSIONAL

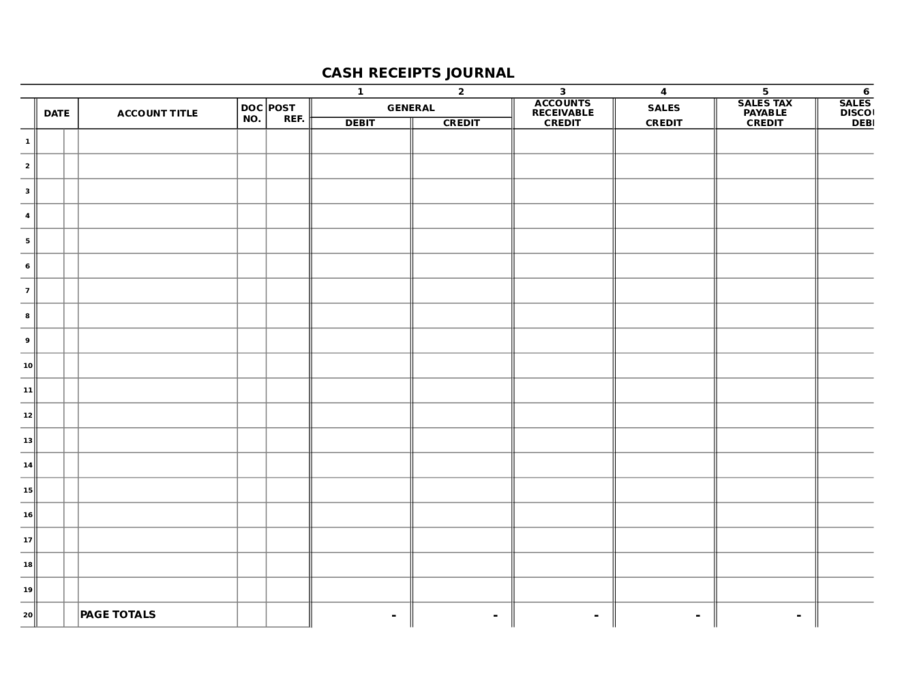

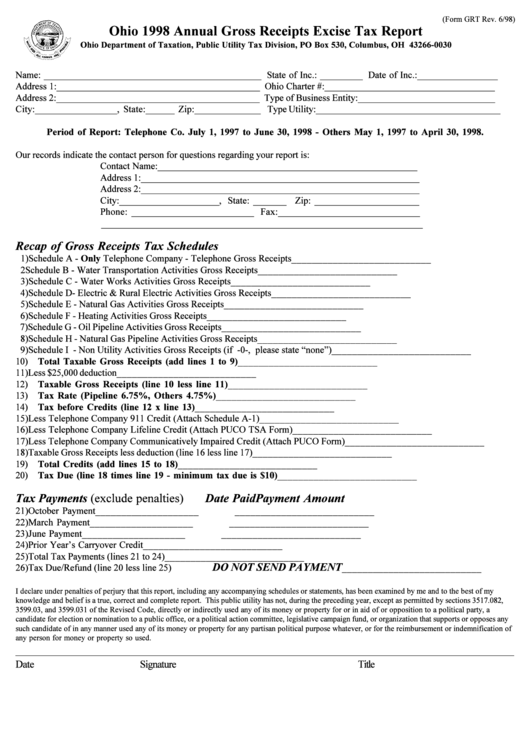

Taxes on gross receipts originated in Europe as early as the 13 th century. The History and Resurgence of Gross Receipts Taxes Taxes on gross receipts generate economic distortions and impose costs in excess of their perceived benefits. Proponents of these taxes make arguments that may seem compelling to policymakers looking for stable and large revenue sources, but this comes with a Faustian bargain. This paper will provide historical context on gross receipts taxes, a discussion of the allure they carry with policymakers, and their economic costs and consequences. While gross receipts taxes have been a tempting source of revenue for states and municipalities, they impose significant costs on the firms, consumers, and workers. Known as “turnover taxes,” gross receipts taxes are a form of business taxation. Having fallen out of favor in the mid-20th century, gross receipts taxes are making a comeback across the country to raise revenue. Unlike a sales tax, gross receipts taxes apply to business-to-business transactions in addition to final consumer purchases. They are not adjusted for a business’ profit levels or expenses and apply to all transactions a business makes.

Unlike a corporate income tax, these taxes apply to the firm’s sales without deductions for a firm’s costs. Gross receipts taxes are applied to receipts from a firm’s total sales. In addition, states should consider reforms to their corporate income tax bases. Well-structured sales taxes can provide reliable revenue with fewer economic costs.

Proponents argue that gross receipts taxes are simpler to administer and calculate than corporate income taxes.

MONTHLY GROSS RECEIPTS EXAMPLE LICENSE

Estimates of the tax due will be deemed unreasonable if they are less than 80% of the actual taxes ultimately due.Īll business license applications are subject to minimum, nonrefundable $30 or $50 fee. Under Virginia Tax Department guidelines, taxes paid by first-year taxpayers based upon estimates will be subject to correction with interest and penalties if an estimate proves to be unreasonable. IMPORTANT: Your first-year estimate must be reasonable. The first year is the only year you will be asked for an estimate. When you apply for a license, you will be asked to provide a good faith estimate of your first year’s gross receipts, and pay an estimated tax. This estimate will be corrected to actual in your second year. Įach calendar year’s BPOL tax is based on the prior year’s gross receipts, except for the first year, which is based on itself.

MONTHLY GROSS RECEIPTS EXAMPLE CODE

Your occupational category is based on your description of your business and possible follow-up questions, in accordance with Code of Virginia guidelines. Different classes of occupations pay different rates, reflecting their relative operating margins.

MONTHLY GROSS RECEIPTS EXAMPLE PROFESSIONAL

Unlike state and federal income taxes, the business, professional and occupational license (BPOL) tax in Virginia is based on your business gross receipts (revenue before deductions).

0 kommentar(er)

0 kommentar(er)